Organize and Scale Your Business

Many businesses like yours struggle to stay competitive as their operations grow more complex, and the key to success is often rooted in the technology that drives them.

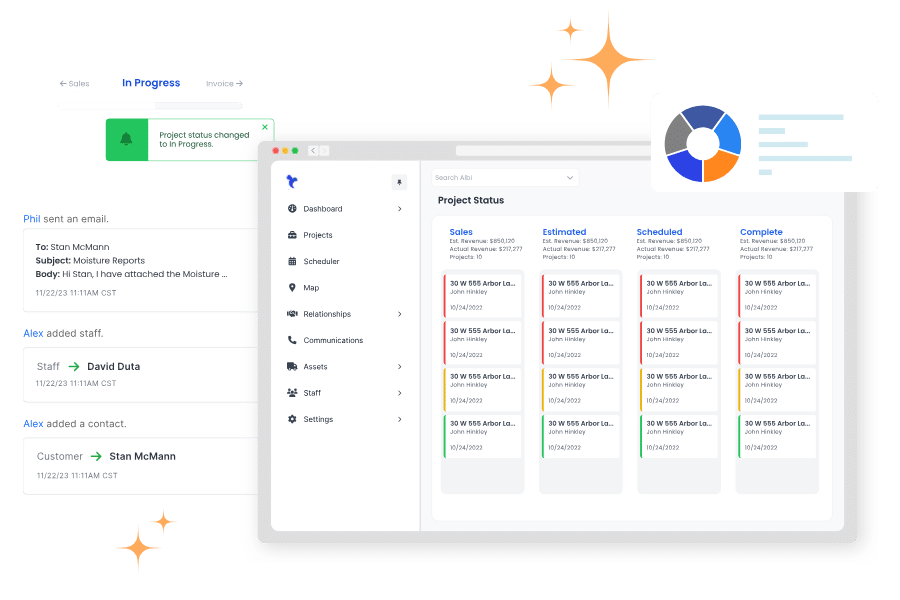

As restorers, we felt the same way and created Albi – a restoration management software that combines all your core business functions in one easy-to-use platform. It seamlessly connects office and field operations while instantly increasing productivity. With automated workflows, you can simplify the processes keeping your company from growing. Albi brings everything together, helping you save time!