Restoration Receivables Guide

Mastering cash flow is a critical piece to scale your restoration business.

Download the Guide Now!

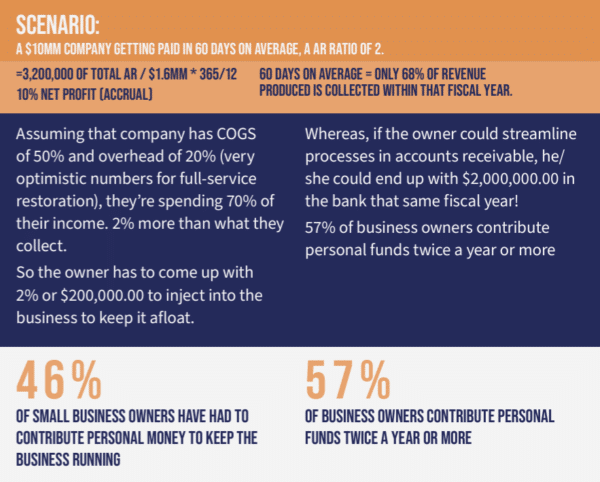

Let’s look at a real world scenario to give you an idea of how a long turn on receivables negatively impacts your business.