Is Net Profit Really All That Important in Restoration?

Last updated: June 26th, 2023

Contents

Throughout my years in the restoration industry, I’ve had many heated discussions with my partner (and father) regarding profitability metrics. He always thought it was better to be smaller and more profitable rather than larger and less profitable. Our consultant would often ask us, “Do you prefer a $10MM company with a 10% bottom line or a $5MM company with a 20% bottom line”, almost rhetorically. An average restorer would pick the latter, which meant less liability with the same bottom line. When I was younger I would constantly challenge that philosophy by claiming the $10MM company has more resources in fulfilling its mission and feeding families. At the time, I didn’t have any evidence to back up my theory other than sentiment and the dream of taking the company nationally.

After studying the technology space for the past 5 years and operating a fast-growing tech company backed by venture capitalists, I can finally concretely justify why net profit isn’t really that important in restoration. A famous rule in venture capital land is the rule is-net-profit-really-all-that-important-in-restorationof 40. Essentially, the net profit of a company + the growth rate should exceed 40. Almost all Fortune 500 enterprises demonstrate this framework, and a lot of them have negative net profits! According to this framework, a company that grows at 300% year over year and has -160% net profit is still WELL within the rule of 40!

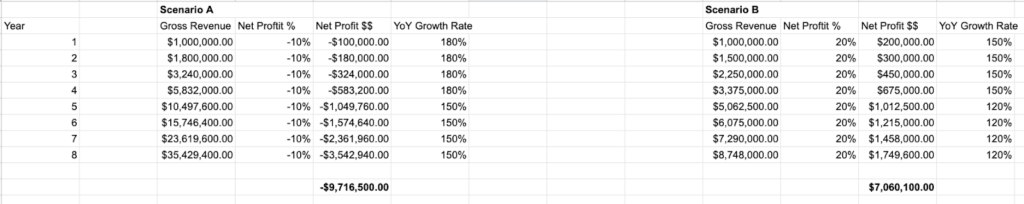

Let’s unpack this scenario and hypothetically look at two scenarios restoration companies could face.

Scenario A is a restoration company growing at 180% YoY for the first 4 years then 150% YoY for the next 4 years. The growth rate is rather conservative considering the capital reinvested. By the end of 8 years, the company has lost $9.7MM. Furthermore, the company has $35MM worth of headaches and the ownership is shelling out $3.5MM to keep the company afloat.

Scenario B is a “healthy” restoration company. Net profit of 20% yearly and growing at 150% YoY. The ownership group would have netted $7MM by the end of the 8-year period, with only $8MM worth of headaches in year number 8.

The one thing that we didn’t take into account is the value of the company at the end of the 8-year period. The average restoration company is selling between 5-8X Ebita. Let’s assume that Ebita is approximately 50% of gross revenue for the year.

In scenario A, the value of the company is roughly $87.5MM. In Scenario B, the value comes out at $20MM. In the 8-year span at an $87.5MM sale, Company A will walk away with just over $75MM (after taking into account the 9.7M cumulative loss) and Company B will walk away with $27MM after taking into account the $7MM distributions over time.

Through this analysis, we can see that option A yields an exit 3 times as big as option B in the long run. This is because the ownership group built a company that grew and became valuable. It’s important to note one thing: the only way this scenario works is if the reason for company A operating negative net profit is due to expansion costs (i.e. hiring sales, marketing, and production people a year in advance to be able to grow into the following year). It’s crucial that company A’s cost of goods sold remains conservative or comparable to company B’s.

I challenge every restorer to build a company considering the exit strategy, not just striving for profitability. Whether the exit actually happens or not, it’s important to be prepared and do everything with a purpose by building value and creating options for yourself and your team. At the end of the day, the most valuable companies provide the highest-valued service to customers and an even higher value to employees.

What you should do now

- Get a Free Demo and see how Albiware can help solve your restoration software challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.