Streamlined Software for Enhanced Efficiency and Improved Communication

Last updated: August 20th, 2024

Contents

There are slow and busy times for the vast majority of restoration contractors. During slower periods, many restorers look at improving their bottom lines. One way in which to do so involves streamlining communications, particularly when it comes to dealing with insurers. During the busy season, most contractors are just trying to ensure they have all their ducks in a row so there will be no problems with payouts from insurance. Restoration software augments a contractor’s ability to efficiently and promptly send off all the information needed so that there’s no delay in payment.

Today’s insurance restoration software keeps delays from affecting cash flow in part by negating the need to fill out physical paperwork that can get lost. It also guarantees that all signatures necessary to authorize work and payment are in the right places, as today’s digital documents require all fields to be filled out completely before sending off claims and other documents needed to approve an insurance restoration. Software for restorers also helps contractors send off photos and videos that support their damage assessments, along with the subsequent estimates for remediation. Many of these benefits directly relate to streamlining communications with insurers and other stakeholders, which restoration software supports.

Optimize your restoration projects with Albi’s management software. Schedule a free demo today to see how we can streamline your workflow and enhance your communication with stakeholders.

Insurance Restoration: Software to Streamline Time from Claims to Job Completion

For contractors who work on insurance jobs, anything that can speed up the time it takes to get a project approved and payments released is a welcome tool. One of the most thankless parts of a restorer’s work often involves dealing with a customer’s insurance. Restoration software helps contractors streamline their communications with insurers by establishing procedures to confirm what work is needed and its cost. Sometimes, it’s necessary to help customers fill out forms correctly to jump through the administrative hoops required to approve work. When a contractor follows these processes precisely, it leads to quicker payments from insurance companies and better cash flow for the contractor, which can help a restoration company grow.

After a project has been completed, a satisfied customer might leave a positive review for a contractor. Yet it’s not just the customer that matters in an insurance restoration. Software designed for restorers helps speed up approvals to remediate damage covered by a customer’s insurance policies. This helps contractors get paid more quickly and also assists their customers in getting the most from their policies. Because contractors who work on insurance jobs have more experience working with insurers’ assessors and other representatives, they understand more about what it takes to get a job approved and paid for by insurance. Restoration software’s benefits also help restorers properly organize a project by communicating and collaborating with all stakeholders so that work is done quickly and efficiently.

Benefits of Restoration Software for Insurance Jobs

The time it takes from signing a contract to completing an insurance-funded project affects a company’s cash flow. Communicating clearly and accurately is important in ensuring a restoration contractor gets paid. Streamlining how long it takes to receive the final payment from an insurer is crucial for restoration companies wanting to expand. With such work, profit often only comes from the final payment from insurance. Restoration software helps in this process, though this is one of its many benefits.

Benefits of restoration software include:

- Automated invoicing simplifies the billing process and allows contractors to communicate seamlessly with insurers’ accounting systems.

- Digital tools integrated with an insurance company’s systems allow quicker and more accurate estimates.

- Helping project managers administer resources more effectively by tracking equipment and personnel in the field.

- Integrated calendars augment scheduling systems that allow real-time updates for meetings – either onsite or virtual – between restoration contractors and insurance assessors.

- Managing insurance claims, restoration software automates intake and processing procedures while minimizing mistakes by decreasing the need for manual data entry.

- Portals that allow both contractors and their customers to track the progress of insurance claims.

- Providing a means to store and retrieve documents, estimates, photos, and insurance claim forms.

- Reporting features that offer insight into costs, timelines, and other KPIs (key performance indicators).

With any construction work, some regulations must be followed to ensure a structure is safe for its occupants, and it’s no different with an insurance restoration. The software helps ensure that a contractor is compliant with their restoration work and that they properly follow the various standards and regulations required by insurers.

Augmenting Communications

Collaborating and communicating with insurers is imperative for projects that rely on money from insurance. Restoration software allows project managers to keep in touch with insurance company representatives and other stakeholders during a job. It also supports teamwork and limits misunderstandings to ensure everyone’s on the same page.

For jobs involving insurance, restoration software supports collaboration by:

- Automated scheduling tools keep insurance representatives updated on an insurance project’s progress.

- Keeping customers updated with automated communications regarding their insurance claims, project start dates, and other relevant information.

- Making it easier to share forms, messages, photos, and other information with insurance companies.

- Providing project managers with multiple means of contacting insurance representatives through emails, messaging apps, phone calls, social media, and texting.

- Streamlining the process of invoicing insurers for work done to speed payment.

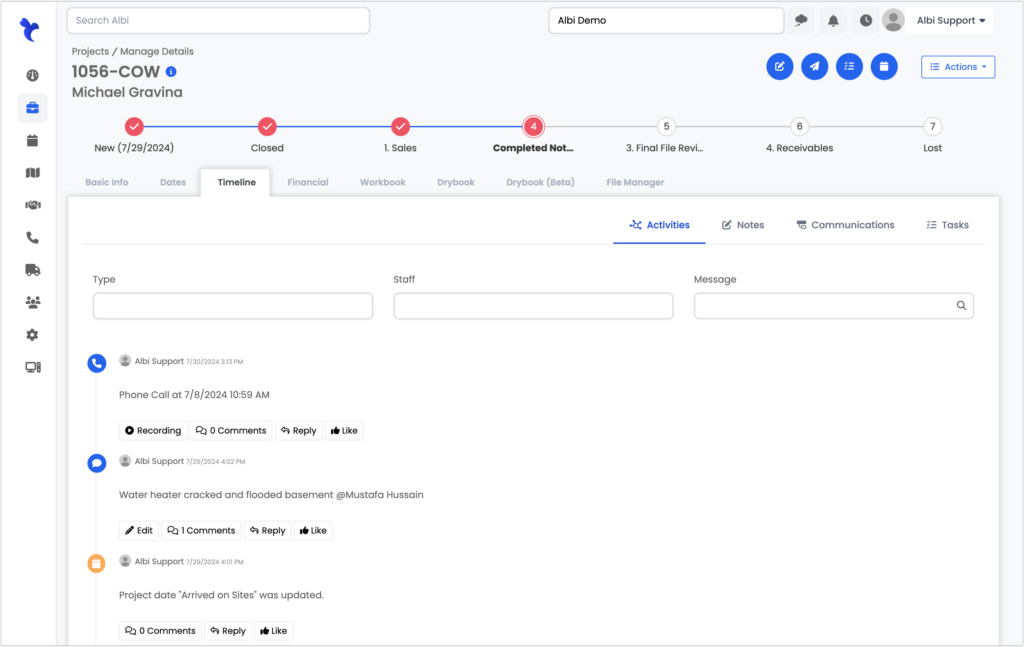

- Restoration contractors can store and organize communications with insurance companies through a single dashboard.

Clear communications ensure a job remains on schedule, decreasing the possibility of any misunderstandings. For example, it can help a contractor establish in real-time how much of the cost of a roofing upgrade would be covered by an insurer without delaying work.

Streamlining Processes

By maximizing efficiency, contractors can speed up the progress of insurance restoration. Software streamlines processes like invoicing, for example, leading to prompter payment. For project managers, restoration software can be used to ensure tools and people are in the right place when needed. This, in turn, enables a project to run more smoothly and with fewer complications, making deadlines easier to keep.

The software also makes keeping track of building plans, contracts, estimates, insurance policies, and other project documentation far easier, as these days, restoration platforms have almost unlimited storage as they’re cloud-based. This means that digitally storing information also allows contractors to record communications with insurance representatives, making scheduling assessments and other meetings easier. It also allows storing information specific to assessors or insurance companies, which can be used to establish preferences on how claims are put together to better serve customers.

Providing Data in Real Time

In conjunction with speeding processes, having data available in real time allows contractors to create detailed reports. This often means a project manager can meet or even exceed the strict documentation requirements for an insurance restoration. Software for restorers also supports data analytics that can be used to glean valuable insights, which in turn can be used to improve efficiency. Data reports can help restoration companies optimize their use of resources.

Both real-time and historical data can make project management easier by predicting the chance of weather-related delays, for example, by looking at past jobs where weather has been a factor and comparing timelines to similar ones without these difficulties. Project managers can better evaluate a subcontractor’s ability to comply on costs and meet scheduled deadlines, along with work quality and other performance metrics. Data-driven can be used for a range of different purposes to optimize the overall efficiency of their operations.

Being able to accurately predict the time a project will take and its costs will, in turn, lead to greater trust. This will not only apply to the happy customer that passes on a referral, but also to the company that issued the customer insurance. Restoration software eases the burden on both contractors and assessors, who can also provide a restorer with referrals by streamlining the process of passing along information vital to ensuring quick approvals and payments upon completion of a project.

Using Albi as Insurance Restoration Software

Albi was made by industry experts who’ve worked on countless insurance-related jobs. Restoration software should offer a platform that unifies project managers, field teams, office staff and other personnel involved a project. Albi helps r contractors communicate and collaborate with all stakeholders by aiding invoicing, scheduling, and other aspects of the restoration business. To learn more about what Albi can do for your business, book a free demo today.

What you should do now

- Get a Free Demo and see how Albiware can help solve your restoration software challenges.

- Read more articles in our blog.

- If you know someone who’d enjoy this article, share it with them via Facebook, Twitter, LinkedIn, or email.